Many employers offer incentives to their employees to encourage them to engage in wellness promoting behaviors. Many of these incentives are monetary in form (i.e., employers either give their workers money or something with a fair market value). By and large, these monetary incentives are taxable, but this may not appear obvious to many companies, largely because the federal paperwork that discusses the taxability of these incentives is tough to comb through and extract central themes from. This raises the question; how many organizations are taxing their wellness program incentives?

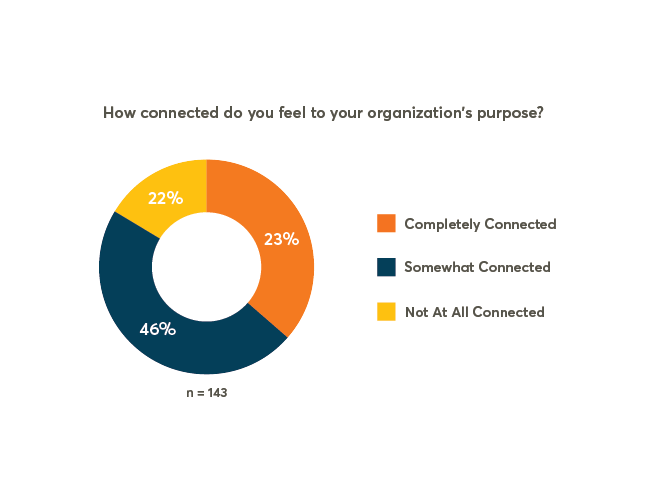

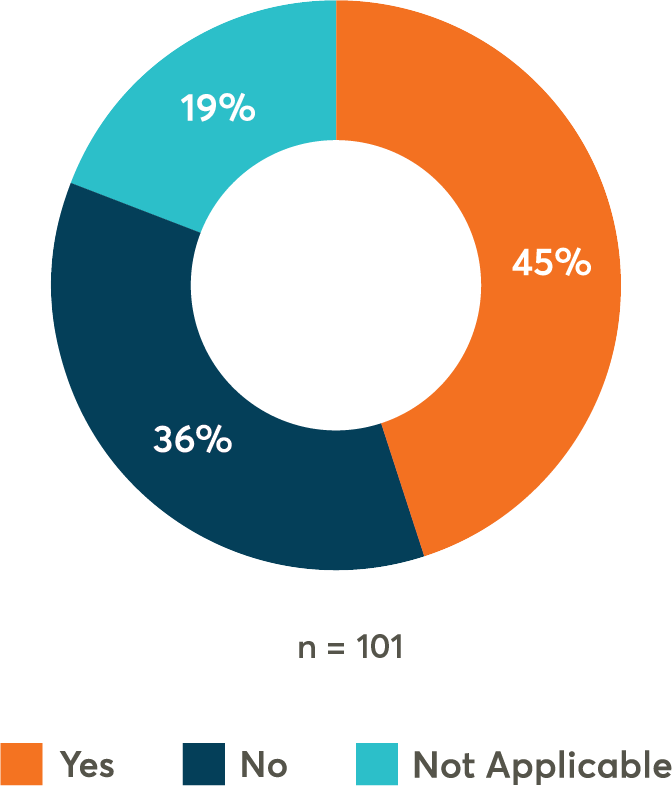

To find out the answer, Wellable asked each member of the large, growing, and dedicated community of human resources and wellness professionals subscribed to the Wellable Newsletter if the organizations they work for tax their wellness program incentives. Forty-Five percent said yes while 36% said no.

Question: Does your organization tax wellness program incentives?

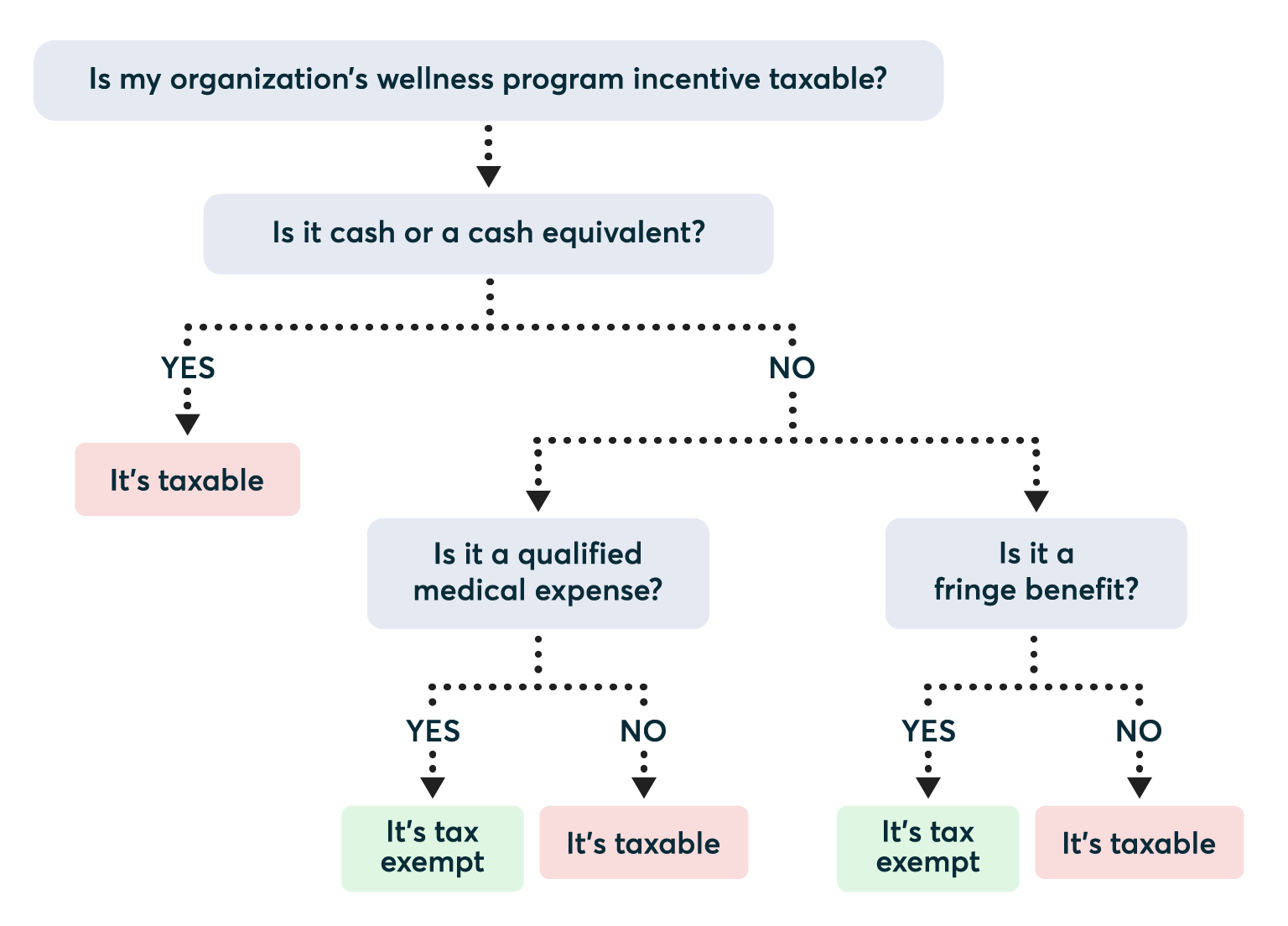

Given that many incentives are taxable, the results probably shouldn’t be so divided. This means that some organizations might be in need of a crash course on the taxability of wellness incentives. To meet this need, Wellable offers a decision tree that provides US companies with a series of questions to help determine if a particular incentive is taxable. Once the decision tree is laid out, additional information is provided to simplify the process of answering its questions.

Cash And Cash Equivalents

The concept of cash is in no need of explanation. Cash equivalents include other assets that are readily convertible into a pre-specified amount, like a $100 gift card. As is noted in the decision tree above, these incentives are always taxable.

Eligible Medical Expenses

According to the sections 105 and 106 of the IRS code, medical care expenses paid either by an employee or their employer are nontaxable. Section 213(a) states that:

Medical care includes amounts paid for the diagnosis, cure, mitigation, treatment, or prevention of disease, or for the purpose of affecting any structure or function of the body.

[Medical care] does not include cosmetic surgery or other similar procedures, unless the surgery or procedure is necessary to ameliorate a deformity arising from, or directly related to, a congenital abnormality, a personal injury resulting from an accident or trauma, or a disfiguring disease.

Some examples of nontaxable medical expenses may include:

- Health club memberships (when prescribed by a doctor to treat an illness)

- Employer contributions to a flexible spending account (FSA), health reimbursement account (HRA), or health savings account (HSA)

- Reduction of cost sharing under a group health plan (e.g., premiums, deductibles, or copayments)

Fringe Benefits

Fringe benefits are typically understood as benefits that are outside a company’s standard health insurance offerings. Many types of fringe benefits are nontaxable (for a complete list, see section 2 of the Employer’s Tax Guide to Fringe Benefits). Some notable examples include:

- Properties or services which have such a small value that accounting for them is impractical (e.g., snacks, water bottles, and t-shirts)

- On-site athletic facilities, as long as they are primarily used by “by employees of the employer, their spouses, and their dependent children

- Qualified employee discounts (these discounts cannot be too large; for a precise account of the rule, check out Section 132(c) of the fringe benefits guide)

Final Takeaways

Seek professional legal or accounting counsel. While the guidance provided here is a good place to start, it is not intended to be exhaustive or perfectly reliable once all of the specifics for any particular company’s situation have been taken into account. As such, it is not a substitute for accounting or legal advice.

Keep employees informed. It is important to let employees know which incentives are taxable and which aren’t. Employees whose taxes are not automatically withheld by their employers must be informed about the taxability of the rewards that they have received so that they can pay the proper amount in taxes and avoid legal consequences.