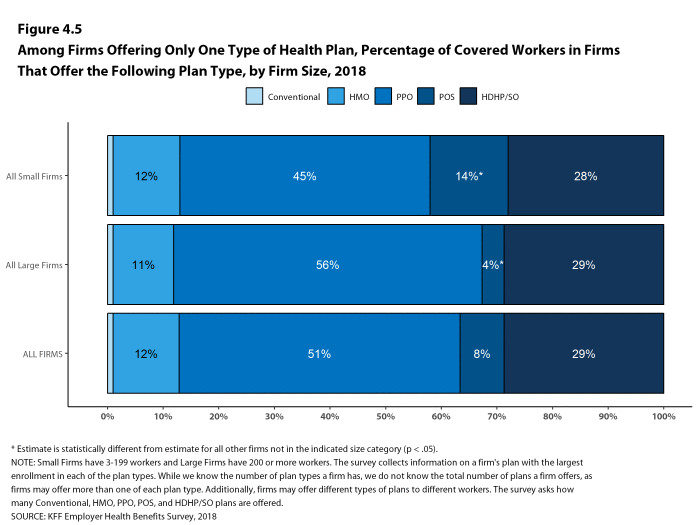

According to research from three organizations, employers are beginning to slow enrollment in high-deductible health plans (HDHPs) and, in some cases, reinstate more traditional plans. This is likely the result of the tightening labor market that provides employees more leverage over pay and benefits. Few employers were moving to the generous coverage a decade or more ago, but they are now questioning their faith in HDHPs.

One of these organizations, the National Business Group on Health (NBGH), surveyed large employers and found that 39% of them currently offer an HDHP as the only option for employees. This number is expected to drop to 30% next year. For many of these employers, the decision was not necessarily about removing HDHPs altogether. Rather, it was driven by wanting to provide employees with more choices. As such, enrollment data in 2019 will be telling about the appetite employees have for HDHPs when other, potentially more expensive, options exist.

A survey from the Kaiser Family Foundation (KFF) found that the portion of employees in HDHPs peaked at 29% two years ago and was unchanged this year. Mercer, a benefits consultancy, released preliminary results from a survey that shows additional data supporting similar dynamics with HDHPs.

There are a number of reasons contributing to the decline of HDHPs. The primary reason is likely that HDHPs have not worked as advertised. Employees have not become smarter healthcare consumers because many medical treatments are unplanned and price comparison tools are not as effective as they were made out to be. Additionally, the Affordable Care Act’s “Cadillac tax” on higher-value plans is repeatedly postponed, meaning that these plans remain as an attractive option for both employers and employees.

Combined with the limited efficacy of HDHPs, the financial burden placed on employees is not consistent with the benefits packages needed in a tightening labor market. The KFF also found that one in four employees now have a single-person deductible of $2,000 or more. For lower-wage employees, the deductible became a stressor that, in the event of unexpected medical expenses, could create a significant financial burden.

Although not all of these issues can be addressed via an employee wellness program, the financial burden from a high deductible could be mitigated by a program that is appropriately structured. Employers can create wellness programs that award employees with Health Savings Account (HSA) contributions to offset the high deductible. Since HSA contributions rollover, employees can grow their savings balance year-over-year, ensuring they are prepared for unexpected medical expenses. As employees engage in healthy behaviors to earn the contributions, they will also be improving their well-being, which should help lower overall medical costs.