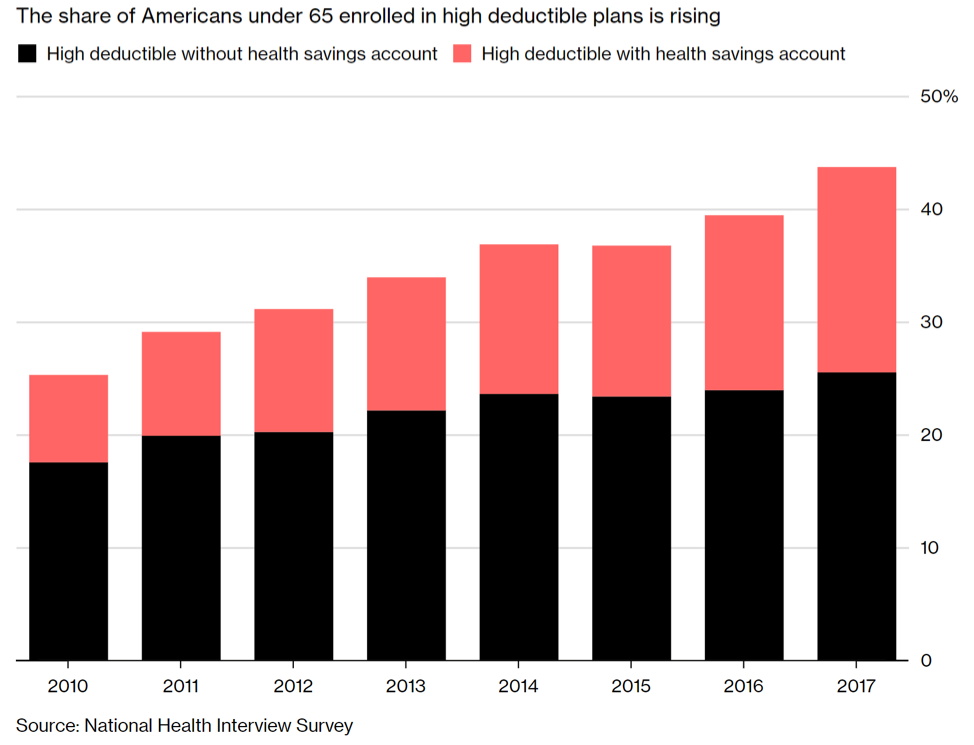

According to a survey by the National Business Group on Health, 39% of large employers offer only high-deductible health plans (HDHPs) to employees for health insurance, which is up from 7% in 2009. The Kaiser Family Foundation reports that half of all employees now have health insurance with a deductible of at least $1,000 for an individual, which is up from 22% in 2009. The rise in popularity of HDHPs has been widely reported, but in short, it is being driven by employers and employees wanting to keep premiums affordable. Also, employers felt that having employees bear more of the cost of care would encourage them to use healthcare more judiciously, cutting back on unnecessary spending and seeking out more affordable providers.

Although lower premiums sound nice and everyone should be better consumers, the problem is that many employees with HDHPs do not have the financial means to cover the deductible, resulting in unforeseen medical expenses putting them in financial turmoil. Bloomberg chronicled the story of Carla Jordan and her husband, John. It is an all-too-common story of a middle-class family with a high deductible that was negatively impacted by unplanned medical expenses.

The Jordans, both 40, were once solidly in the middle class, but ever since the 2008 financial crisis, money has been tight at best. Then calamity hit. In 2016, Carla needed a gallbladder operation. Her husband John suffered a seizure the same year, followed by an unrelated infection that sent him to the emergency room. Toward the end of the year, Carla was diagnosed with diabetes. Even after paying $501 a month for medical insurance, they ended the year owing $8,000 to 18 different providers, with creditors threatening to garnish John’s wages.

– Bloomberg

The bottom line: People like the Jordans simply can’t afford to get sick. According to the Federal Reserve, 41% of individuals say they can’t pay a $400 emergency expense without borrowing or selling something. This is while the average family deductible in employer-sponsored high-deductible plans is steadily increasing, growing from $3,511 in 2006 to $4,547 in 2017. The result is that numerous families and individuals are exposed to incredible financial risk, and they are often delaying routine care or skipping medication, both of which could life-threatening.

Employers are beginning to realize the problem, with a number of them, such as JPMorgan Chase and CVS, recently announcing plans to reduce deductibles. This may remove some individuals from risk, but based on the statistics above, many more will still be exposed. Another option companies could utilize in conjunction with reducing deductibles is facilitating employees to live healthier lives to reduce the likelihood of an unexpected medical event. This is best accomplished through a well-constructed wellness program. Also, employers could promote the use of or help fund Health Savings Accounts (HSAs).

An HSA is a tax-advantaged medical savings account available to taxpayers in the United States who are enrolled in a HDHP. The funds contributed to an account are not subject to federal income tax at the time of deposit. With 58.3% of the 44.7% (2017) Americans under the age of 65 using HDHPs forgoing the use of an HSA, the room to make a large impact is high. Since many solutions work best in pairs, employers would be wise to combine their wellness programs with an HSA strategy. This would include awarding employees with contributions to their HSA account for participating or hitting certain milestones in the employee wellness program. The result is employees work towards better health while creating a tax-deferred fund to offset unexpected medical expenses. HSA Health Plan, a Wellable customer, does this by allowing all of its members to earn up to $20 per month in their HSA account for reaching certain activity goals.

Employers could also invest in financial wellness programs to help employees increase their savings so that they could afford the deductible in the event of a large medical bill. One part of the financial program must include the promotion of HSA accounts so that employees use the tax benefits to increase financial security. This will further integrate the employee wellness program with the solution to addressing crippling deductibles.