The growing student debt crisis is often thought of as a problem associated with millennials, and as such, employers make the common mistake of assuming student debt benefits will only appeal to a limited number of employees. Baby boomers, many of which have children preparing for, currently in, or recently graduating from college, are increasingly taking on some or all of the student debt burden from their heirs. “Some do it because they want to and some do it because they have to,” according to Tuition.io CEO, Scott Thompson.

One of the factors increasing the number of baby boomers assuming student debt late in their lives is the borrowing capacity of young adults. As costs of higher education continues to increase and wages in many industries stagnating, students are not able to take on additional debt to fund the final years of their education. As a result, their parents must fill the void. A real-life example of this burden being passed to older generations is at Estée Lauder Companies. The company, recognizing the adverse health impact student debt causes its employees, launched a student loan contribution benefit program. Employees are eligible for $100 monthly contributions to their student loan payments with a cap of $10,000. Conventional thinking would suggest that a disproportionate number of millennials would participate in the program relative to other generations. This would be incorrect. Six in 10 of the company’s 46,000 global employees and 65% of those currently enrolled in student loan program are millennials. Nearly the same portion of eligible employees and program participants are millennials.

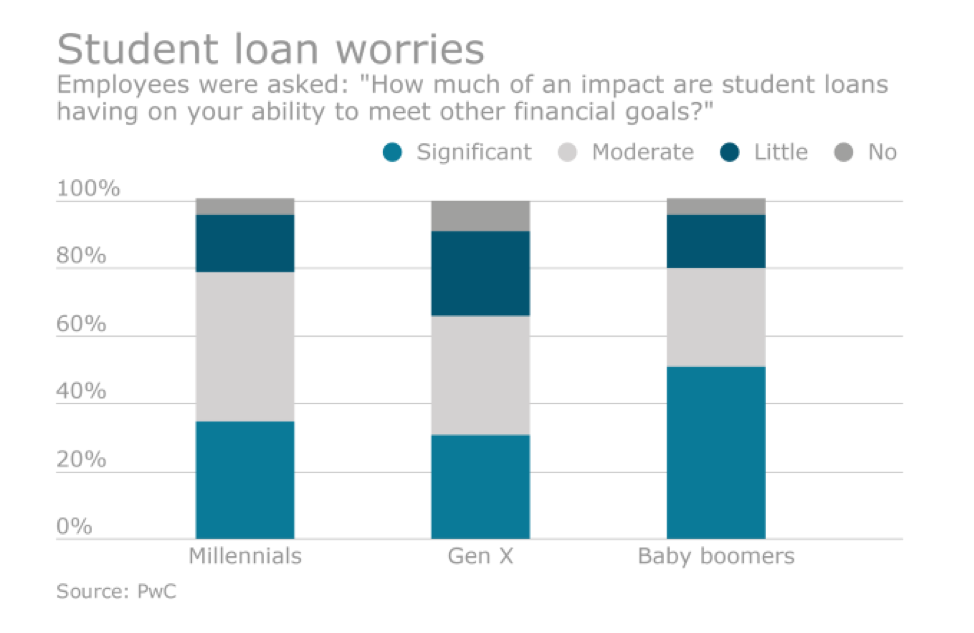

Another indicator that baby boomers are also victims of the student debt crisis is captured in the results of the PricewaterhouseCoopers (PwC) survey below. More baby boomers identify student loans as having a significant impact on their ability to meet financial goals that millennials and Generations Xers.

It is easy to believe that only millennials would be interested student debt relief, but this is not the case. Employees of all generations are seeking financial security, and large amounts of student debt is making financial independence harder to achieve. Employers can provide an attractive 401(k) matching program, but if employees cannot contribute to the plan because of debt payments, the benefit does nothing to help their financial security. Not every employer can provide tuition reimbursements or student loan contributions, but every employer can at least provide financial wellness education to help employees find a path to financial health. There are a number of providers, including Wellable, that offer free financial wellness seminars on a number of topics. Employers should use these free resources to alleviate the stress caused by financial burdens until they can enact more financial health benefits.