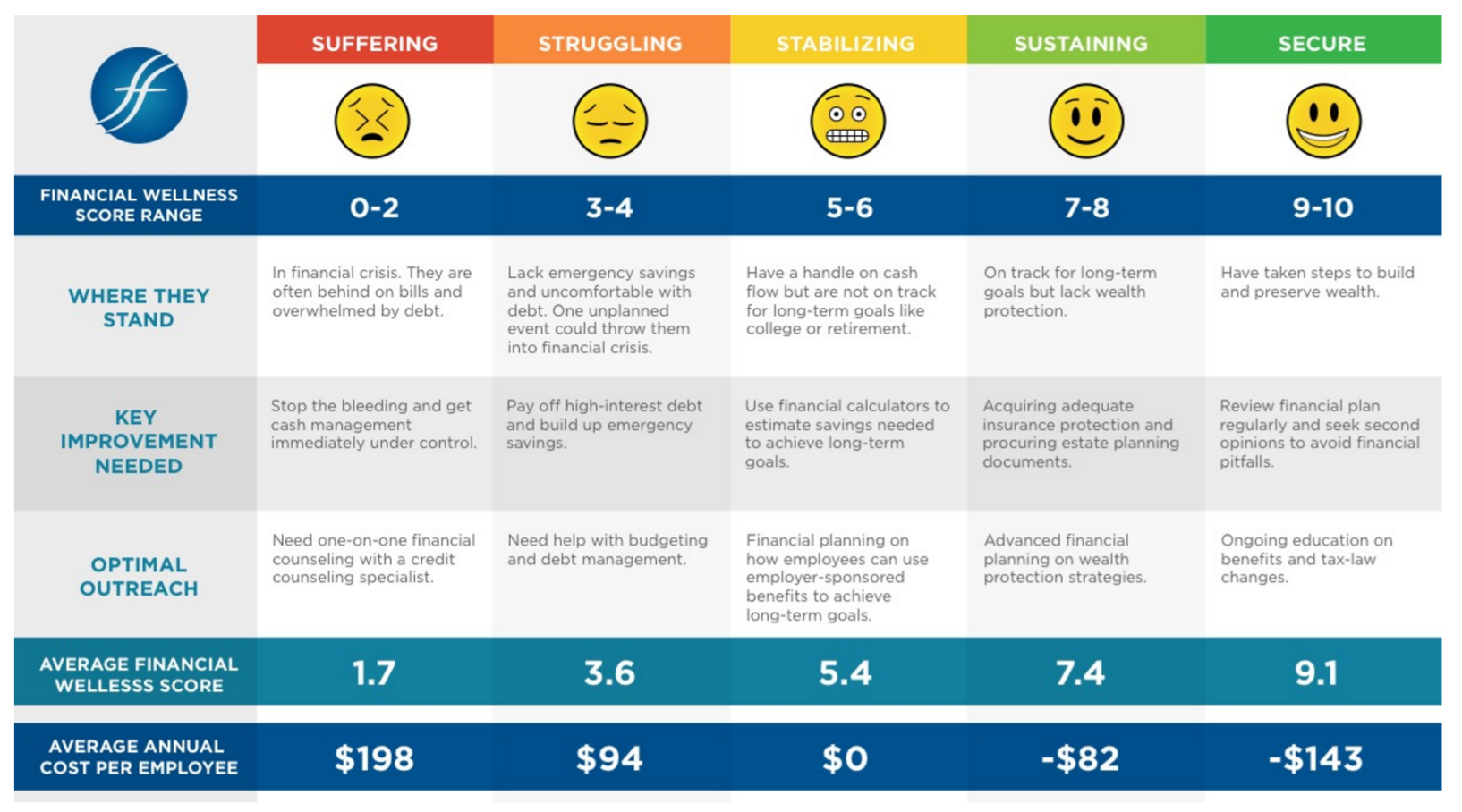

A study from Financial Finesse shows that the burdens of financial stress have significant and tangible impacts on employers and employees. As a result, proper financial wellness tools have the ability to significantly benefit both parties.

“For its 2016 ROI Special Report, Financial Finesse conducted a case study of a Fortune 100 company’s comprehensive workplace financial wellness program from 2009 to 2014. Depending on employer size, employers can save up to $433,007 in garnishments, up to $682,034 in flex spending/health savings, and up to $4,347,275 in absenteeism by improving the workforce’s financial wellness score from 4 to 5 on a 10-point scale. The savings is even greater when improving the workforce’s financial wellness score from 4 to 6.” Savings from flex spending/health savings accounts are a result of greater contribution rates from employees with higher financial wellness scores. When an employee increases his or her contribution to one of these pre-tax savings accounts, an employer has lower FICA tax expenses.

The study also found higher financial wellness scores correlate with the ability and choice to make increased retirement saving deferrals. Although employees overall were not saving the recommended 10% to 15% of their income for retirement, those with higher financial wellness levels made larger contributions on average. An analysis of retirement plan contribution rates found that employees that improve their financial wellness score from 4 to 6 could potentially improve their retirement plan balance by more than 27%. Increased savings reduces financial stress, and as a result, employees may have improved overall health.

Financial wellness programs are just beginning to become staples of employee health programs. For organizations looking to incorporate financial wellness into their benefits offering for the first time, there are a number of budget friendly options to choose from. For those employers with a 401 (k) plan, the plan administrator should have free financial wellness resources for their clients to use. There are also a number of advocacy groups and wellness vendors that offer a free financial wellness seminar/webinar.