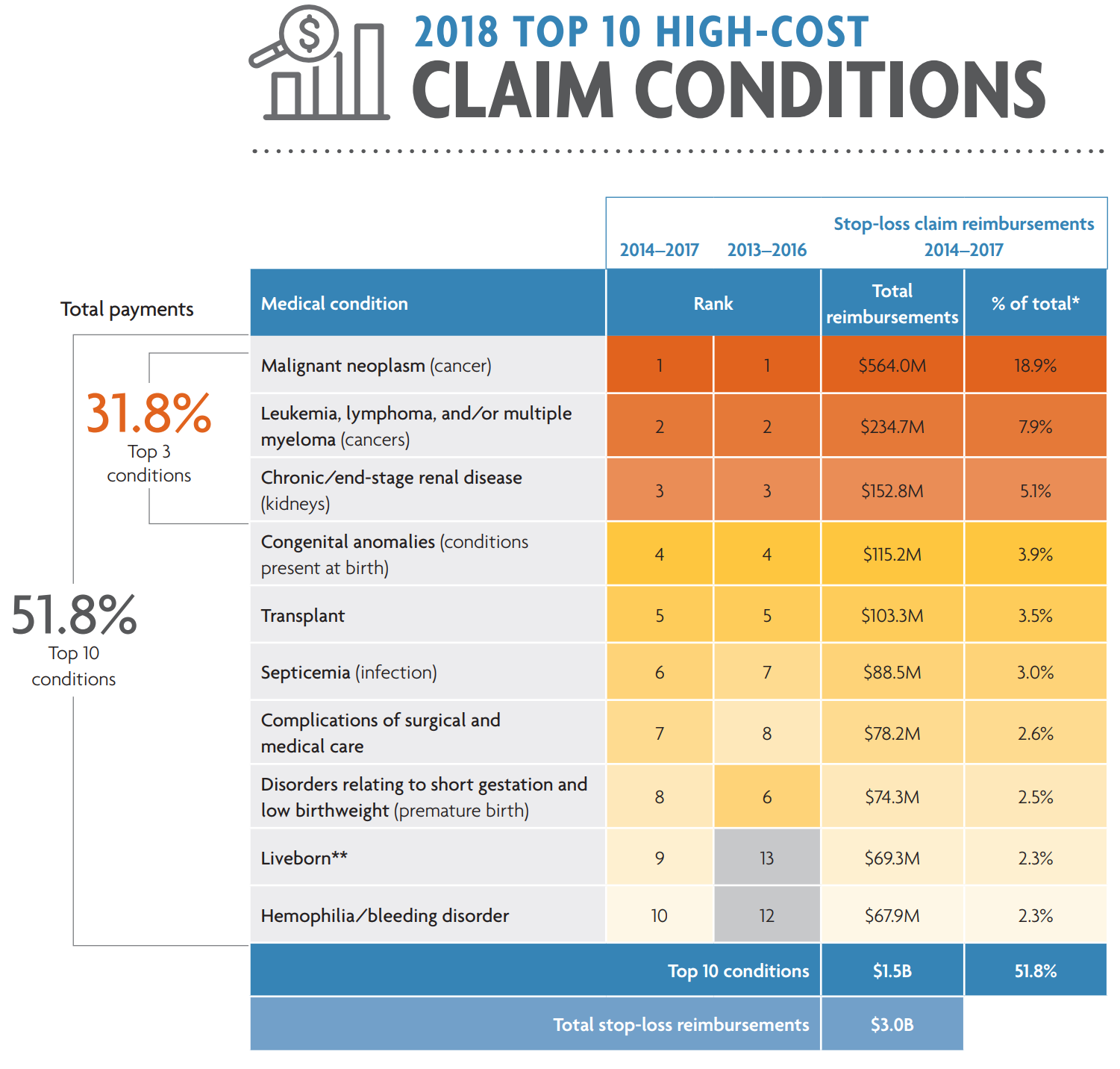

According to a report from Sun Life Financial, the number of patients with claims that exceeded $1 million grew from 104 to 194 between 2014 and 2017, reflecting a 87% growth rate. The total spending on such claims grew to $935 million. In the press release accompanying the report, Sun Life President Dan Fishbein noted that the significant growth in the number of large medical claims may be the “result of new life-saving treatment options coming to market, as well as existing treatments getting approved for expanded use.” Specifically, the trend is largely driven by expensive cancer treatments and other advances in medical technology, such as gene therapy. As the prevalence of certain diseases and medical technology increase, employers should expect the number of large medical claims to follow suit. Regardless of the cause, self-funded employers are bearing the financial burden, either directly or through increasing premiums for stop-loss insurance.

Data points like these understandably make employee wellness programs that focus on return-on-investment (ROI) very compelling. ROI-based programs incorrectly believe that a health risk assessment coupled with a biometric screening and some clinical programs can prevent a catastrophic medical event and large medical bill. The amount of dollars saved by preventing one large medical bill is so significant that it makes the investment in these types of programs logical, assuming they can reliably prevent a large medical claim.

Unfortunately, it is wishful thinking that archaic wellness programs like these actually work. For starters, these types of programs do not materially improve the health of a population. For argument’s sake, let’s assume that an ROI-focused program can improve population health and that a large medical bill is generated from a preventable medical event such as cardiac disease. Certain identifiable risk factors do increase the likelihood of an employee having a heart attack or stroke, but even if the health of a population as a whole does improve, the likelihood that it prevents a large medical claim is relatively low. Based on 2017 data, only ~2 of every 1,000 employees actually suffered a stroke or heart attack. The cost of preventing one of those events is very unlikely, especially with the participation rates many employee wellness programs experience. There is no doubt that the potential savings would be significant, but the math does not suggest a ROI is likely.

This is not to say that employee wellness programs are not wise investments. Rather, it suggests that not all programs are created equal, and ones that claim to generate a financial ROI from reduced medical expenses are at the bottom of the pile. Employers will need to grapple with the challenges associated with large medical expenses, but this problem cannot be addressed by programs that claim to lower the number of catastrophic medical events experienced by employees of a single company.