The Sad Math Of Retirement Healthcare Spending

On average, a 65-year old couple retiring today needs $275,000 to fund future healthcare expenses, according to Fidelity Investments. According to JP Morgan, healthcare expenses increase approximately 33% during retirement as a percentage of total spending.

Despite these staggering numbers, many individuals, especially millennials, are not taking the proper steps to ensure their financial and healthcare security.

Enter The HSA

Most U.S. adults plan to fund their retirement through a combination of Social Security and personal savings. The savings components are generally a combination of retirement investments (IRA, 401(k), etc.) and banking or brokerage accounts. Those individuals that have a pension to look forward to should consider themselves fortunate because those days are waning.

Another option, albeit underutilized, is to treat a HSA as a specialized retirement savings vehicle. It is important to note that HSAs are not an option for everyone. HSA owners must be enrolled in a qualified High Deductible Health Plan (HDHP). Just like one invests in diversified mutual funds in a 401(k) or Individual Retirement Account (IRA), so too can it be done in an HSA. The biggest reason for doing this is that you either don’t expect to spend the whole balance or you make enough money to cover the deductible out-of-pocket while letting your HSA contributions grow in an investment account.

Not An FSA

The employee benefit acronym soup does an amazing job confusing all of us. For many, the first question posed when discussing HSAs for the first time is “don’t you need to spend the balance before year-end?” This comment confuses a HSA with a FSA, or Flexible Spending Account. The two accounts are separate and distinct, and the HSA is much more beneficial to employees. First, there is no use-it-or-lose-it provision, which allows dollars to be invested and grow tax-free. Second, if an employee moves to a new company, they can take their HSA account with them. They also can spend it using a card linked to the account or make investments with the balance.

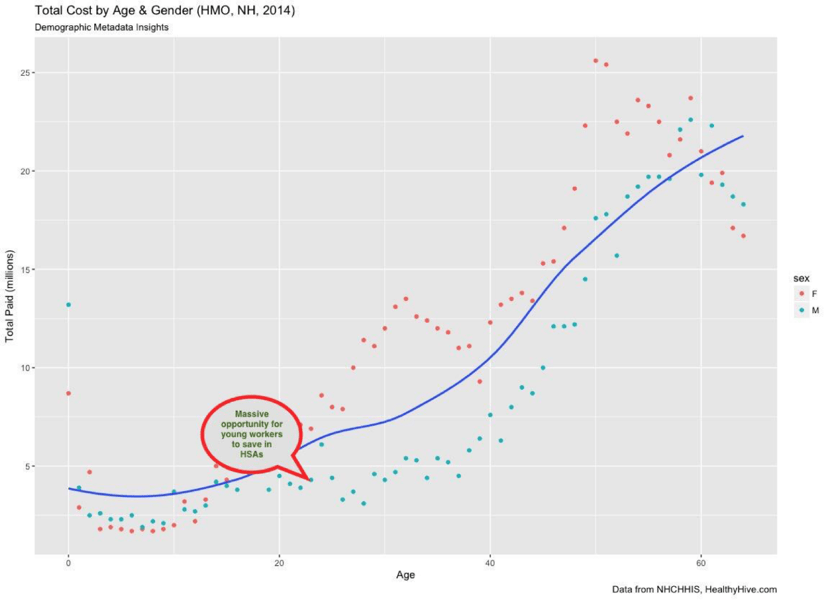

Young Invincibles

Although retirement and future healthcare expenses may seem like distant concerns for millennials, this demographic is ripe to take advantage of the benefits associated with HSAs. The exhibit below illustrates how young employees are at that stage in their lives where healthcare expenses are not a large expense, which explains why this demographic tends not to fully consider the future impact of these costs. This group would be very wise to max out HSA contributions and invest the money so funds can experience compound growth over the next 40 to 50 years. Even doing this for a few years would still result in meaningful healthcare spending funds in retirement. Saving $3,000 for 3 years into an HSA that earns 5% will result in $9,688 at the end of the third year. But over the next 35 years, those savings grow to more than $53,000. Since the amount is not taxable upon withdrawal, it is really the equivalent of having $71,254 in an IRA that will be taxed upon withdrawal (assuming a 25% marginal tax rate).

Financial Advisors Add “Financial Doctor” To Toolkit

Investment HSAs are in fact a hot topic today among many financial advisors and asset managers. Financial advisors love adding more value to their practice as it enables them to differentiate and improve their clients’ financial wellness profiles. Financial advisors can incorporate education about the HSA triple tax-advantage — when spent on qualified health expenses, HSA funds are literally never taxed! HSAs can also provide more flexibility in tailoring financial plans for clients— Unlike IRAs, HSA funds do not need to be withdrawn at age 70.5. If the client ends up being a very healthy retiree, HSA assets can continue to compound for years into the future.

Finally, financial planners can inform clients about the obscure and massively under-utilized IRS rule that allows HSA owners to fund their HSA by using IRA assets. It can only be done once in a lifetime and the HSA owner must remain enrolled in an HDHP 12 months from the time of the IRA to HSA funding. The benefits are huge because the HSA funds can then grow tax-free over time. Expect to see an emerging trend where financial advisors are better equipped to act as financial doctors when it comes to planning for healthcare affordability in retirement.

Word Of Caution

It is important to note that treating an HSA as strictly an investment account is not the right move for everyone. Many consumers with HSAs expect to spend the funds that accumulate over the course of the year. If you have an HSA and you expect to spend the money, it could be risky to invest the balance in stock and bond mutual funds. However, some HSA providers include a debit spending card that is integrated with the investment account. Such a structure still allows a surplus balance at the end of the year to be invested, even if it’s less than $1,000.

For employees that are young and healthy or are high income earners, an emerging workplace “best practice” is to fund the 401(k) at least up to the employer’s match and then fund the HSA. Funding an HSA is an ideal way to super-charge retirement savings.

This submission is for informational purposes only and should not be taken as tax, medical, or investment advice.

This post was written by Wellable guest blogger, Carl Hall of HealthyHive. HealthyHive supports investment advisors, asset managers, and financial planners by helping to educate their clients on the advantages of using HSAs as a retirement savings vehicle. The company’s offering comprise investment-based HSAs integrated with financial wellness decision tools and big data predictive analytics.