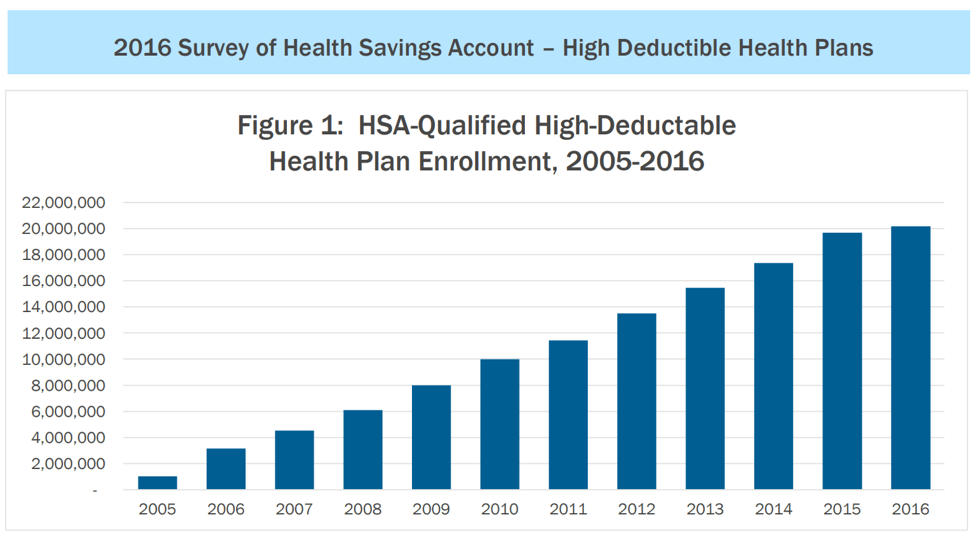

For employers and organizations currently using or thinking about adopting high deductible health plans (HDHPs), lots of news came out last week that is worth noting. Although HDHPs have seen incredible growth since 2005, many industry professionals often assume (incorrectly) that employers are continuing to flock to these types of health plans, causing enrollment to surge. According to DirectPath and Gartner’s 2018 Medical Trends and Observations Report, HDHPs growth remained relatively static this year. This is the fourth consecutive year of minimal growth in the prevalence of HDHPs.

|

| Source: America’s Health Insurance Plans (AHIP) |

One of the benefits of HDHPs is the ability to have a Health Savings Account (HSA). HSAs let account holders set aside money on a pre-tax basis to pay for qualified medical expenses. In fact, they are triple tax-free, which is why they are attractive to the point that one could argue that they should be used by employees as a retirement account. Also, proposed legislation (H.R. 5138) in Congress may make them even more attractive to employees by allowing account holders to use the funds to for wellness benefits, including exercise. The legislation will also offer pre-deductible coverage for medication and services that help manage chronic conditions as well as for health services provided at both onsite employee clinics or retail health clinics. If passed, this expansion of benefits available to HSA holders may re-catalyze HDHP growth.

HSA Bank Health & Wealth Index was also released last week and shared some interesting findings with the world. The report explores how today’s consumers are faring when it comes to their financial and physical health. The results were based on responses from more than 1,000 U.S. adults on their health plan enrollment status, health practices, ability to pay for health-related expenses, and level of engagement in their own health and wealth. Each survey participant received a health score and a wealth score, which were combined to produce their overall health and wealth consumer index score. “The average index score for consumers enrolled in an HDHP was 75.5, placing them in the optimally engaged category and higher than the average consumer score of 62.4.” This shows the potential of HDHPs in facilitating physical and financial health amongst its members.

The results from the survey also showed that 41% of respondents never save money for future healthcare expenses and 35% never consider cost when selecting health services, both of which should be major concerns for employers. Employers need to make sure the they provide employees with the educational resources to take advantage of the tax benefits of HSAs as well as take precautions to limit the financial risks that HDHPs may subject them to.