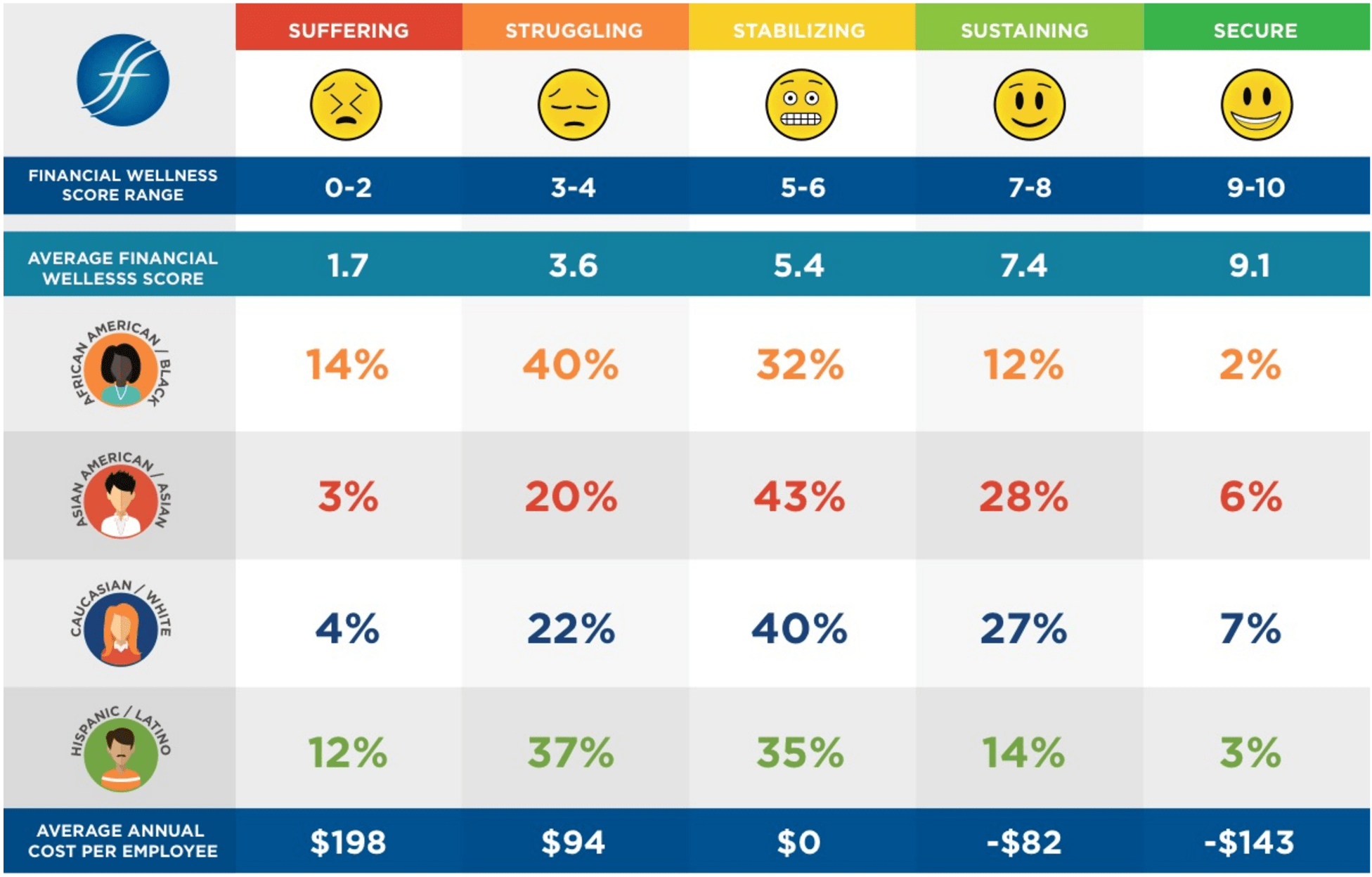

Finance Finesse recently released a report called Optimizing Financial Wellness Programs for a Diverse Workforce. The results are concerning, as minority employees are overwhelmingly struggling with financial wellness. This is bad news for a number of reasons because the same organization released the 2016 ROI Special Report where it noted that employees with the lowest levels of financial wellness cost employers between $94 and $198 a year. At this price, companies of all sizes should appreciate the savings from getting these financially struggling employees back on track.

Financial Priorities

Specifically, 54% and 49% of African Americans and Hispanic/Latino workers, respectively, are in the Suffering or Struggling categories. Compare this number with only 23% of Asian Americans and 26% of Caucasians workers. Similarly, 25% of Hispanic employees and 31% of African-American employees reported that they have high or overwhelming levels of financial stress. Paying off debt is one of the largest priorities for these two groups, making it hard to save for anything else. As a result, 63% of Hispanic employees and 74% of African-American employees don’t have funds available to pay for emergency events.

Lack Of Financial Wellness Education

Even though income inequality is still prevalent and needs to be addressed, a lot of this insecurity also boils down to financial wellness education (or lack thereof). For example, 48% of African-Americans and 36% of Hispanic employees said that they don’t have a handle on their cash flow. If this is caused by employees living above their means or dealing with competing priorities, meeting with a financial advisor or taking a financial wellness class is a good first start to help them get back into control of their financial situation.

Everybody Needs Help

While it is important for employers to recognize the need for financial literacy among minority employees and offer help, other groups should not be left out. In fact, almost all employees can use some financial wellness education. Only 18% of African American, 20% of Hispanics, 30% of Asians, and 30% of Caucasians said they were on target to replace 80% of their income at retirement. Along the same line, “financial security” is a status that very few have achieved – only 2% for African Americans, 3% for Hispanic/Latinos, 6% for Asian Americans, and 7% for Caucasians.

Financial wellness programs are just beginning to become staples of employee health programs. For organizations looking to incorporate financial wellness into their benefits offering for the first time, there are a number of budget friendly options to choose from. For those employers with a 401 (k) plan, the plan administrator should have free financial wellness resources for their clients to use. There are also a number of advocacy groups and wellness vendors that offer a free financial wellness seminar/webinar.