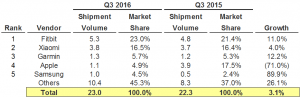

According to a new report from IDC, market share in wearable device shipments for Q3 2016 saw fairly little shifts relative to previous quarters but growth dropped significantly, reaching the single digits for the first time. Most notably, the Apple Watch saw its number of shipments drop 71% year-over-year. Fitbit and Garmin were the only two leading brands to reach double digit growth. Total shipment volume for the quarter came to 23.0 million units, up just 3.1% from the 22.3 million units shipped in Q3 2015. The table below breaks down the details of the shipments and ranks the leaders by market share.

It is important to note that these numbers reflect both basic wearables, which account for 85% of the market, and smartwatches. Basic wearables still grew in the double digits despite a significant slowdown and the number of smartwatch units dropped. The data provides a number of insights into the wearable market so we thought we would talk about some of them below.

Fitbit Remains At The Top

Fitbit ended the quarter the same way it began it: as the undisputed worldwide leader of wearable devices, although their lead continues to shrink. In Q3 2016, the global leader was able to hold their top ranking with market share in line with Q3 2015 (23.0% vs. 21.4%). Growth was driven by the long-awaited refresh for the Charge HR with the Charge 2. Rumors continue to surface that Fitbit will be acquiring smartwatch manufacturer Pebble, which reflects their desire to move beyond just basic wearables into the smartwatch market in a big way.

Xiaomi Struggles

Xiaomi’s continues to carve out a market for affordable wearable device with lots of functionality. The new “Mi Band includes heart rate tracking and is priced well below any competition, making it more suitable for impulse buying than any other fitness band.” Despite its price advantage, Xiaomi delivered approximately the same number of units year-over-year (3.8 million vs. 3.7 million), resulting in similar market share from 16.4% in Q3 2015 to 16.5% in Q3 2016. Despite the basic wearable market growing in the double digits, Xiaomi growth was only 4.0%. Xiaomi continues to struggle to gain any significant traction outside its home country of China.

Garmin Expands Product Portfolio

Coming in third, Garmin offers one of the broadest product portfolios in the market, from the low-cost, corporate-only Vivoki to higher end smartwatches with GPS. Garmin experienced modest growth of 12.2%, growing the number of units shipped from 1.2 million in Q3 2015 to 1.3 million in Q3 2016. The brand continues to be a favorite of fitness fanatics.

Apple Tanks

Apple saw a steep drop in it units shipped. Apple shipped only 1.1 million units in Q3 2015 compared to the 3.9 million units in shipped in Q3 2016. It is important to note that Apple launched its second-generation watches in mid-September so those numbers have little impact on Q3 2016. With the holiday season coming up and a full quarter of results from its new device, Apple may be able to recover from this decline.

This challenge is why Wellable encourages the implementation of a bring your own device (BYOD) strategy for wellness. A BYOD strategy for wellness allows employers to embrace all forms of wellness technologies, including devices and apps that are not Fitbit, Apple Watch, or Xiaomi. It will enable consumer choice and result in lower costs for your program. Download our free white paper for more information on BYOD for wellness.