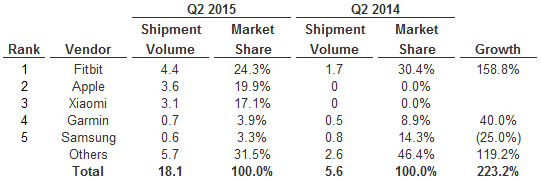

According to a new report from IDC, the Apple Watch is now the number two wearable coming in just behind market leader Fitbit during the second quarter of 2015. Apple shipped a total of 3.6 million units in Q2 2015, just 0.8 million units behind Fitbit’s 4.4 million units. Total shipment volume for the quarter came to 18.1 million units, up 223.2% from the 5.6 million units shipped in Q2 2014. The table below breaks down the details of the shipments and ranks the leaders by market share. After Fitbit and Apple, Xiaomi, Garmin, and Samsung round out the third, fourth, and fifth places, respectively. Samsung narrowly edged out Huawei and Jawbone to remain among the top 5 vendors during the quarter.

The data provides a number of insights into the corporate wellness market so we thought we would talk about some of them below.

Apple Watch Enters With Big Splash

This probably comes as no surprise, but the Apple Watch entered the wearables market with a big splash. Unfortunately, the only people getting wet are consumers. With a price tag starting at $350, the Apple Watch is not a device that corporate wellness programs will be able to buy for employees. That being said, fitness tracking is a key feature in the Apple Watch so employers should make plans to accommodate those consumers who purchased the device on their own by allowing them to use it within their corporate wellness program.

Fitbit Continues Their Dominance

Fitbit’s first place finish in shipments sold also came as no surprise to wearable aficionados. Their Q2 2015 reads like a list of successes: triple-digit year-over-year worldwide volume growth; double-digit year-over-year worldwide revenue and profit growth; expanded partnerships with corporate wellness groups, fashion, and food companies; and increased visibility in the media. Despite coming in second with just 800,000 shipped devices fewer than Fitbit, the Apple Watch doesn’t have the years of being in the market and the huge installed base as Fitbit. With more affordable devices and the highest adoption rate of any device, accommodating for Fitbit devices in the workplace is a must have for every corporate wellness program.

Xiaomi: The Dark Horse Of The Wearables Market

The name recognition of Xiaomi’s Mi Band is far below many of its competitors, but it is taking on companies like Apple and Fitbit for control of the wearable market. Compared to other best-selling wearables, the Mi Band looks underwhelming. It can’t display notifications, connect to third-party apps, or even tell the time. However, its simplicity helps it sport a 30-day battery life, which makes it less likely to end up in a drawer because users forgot to charge it. Also, its low price ($15) makes it a realistic buy for corporate wellness programs that want affordable devices that track steps and sleep. According to IDC, 97% of these devices are being sold in China so it may be a while until the U.S. sees the impact from the Mi Band.

No Company Made Up More Than 25% of Q2 2015 Market Share

Despite their huge success, none of the top producers made up more than 25% of Q2 2015 market share, which makes it challenging for a corporate wellness program to rely on the adoption of a single device to promote consumerism within their company. Wearables are becoming more popular, but employees are using different devices to track their health. Even if an employer is able to purchase devices, employees will want to use their own. Try convincing an Apple Watch user to give his or her device up for a Fitbit Flex that their company bought them.

This challenge is why Wellable encourages the implementation of a bring your own device (BYOD) strategy for wellness. A BYOD strategy for wellness allows employers to embrace all forms of wellness technologies, including devices and apps that are not Fitbit, Apple Watch, or Xiaomi. It will enable consumer choice and result in lower costs for your program. Download our free white paper for more information on BYOD for wellness.