With Fitbit recently filing for its initial public offering, a significant amount of data about Fitbit and the consumer wearable market is finally available to the public. As the widely recognized leader in the wearable tracker market, Fitbit’s success and challenges can be seen as reflective of the market as whole. A review of the public filing identifies two big takeaways for corporate wellness programs: (i) Fitbit and the wearable tracker market are growing tremendously and (ii) the industry has a major attrition problem.

The Good: Growth

Since its launch in 2009, Fitbit has been growing 246% annually from 2010 to 2014, including 175% growth in 2014 to $745.4 million in revenue. This growth has been support by a higher average sales price, which means users are buying more expensive devices (Fitbit released its first non-recalled device above $99 in Q4 2014). The growth in the number of devices sold highlights the level of penetration wearable devices are having in the market. It will be important for corporate wellness programs that do not have the budget for wearable devices to remember that the large and growing installed base can still be leveraged within a program.

The Bad: Attrition

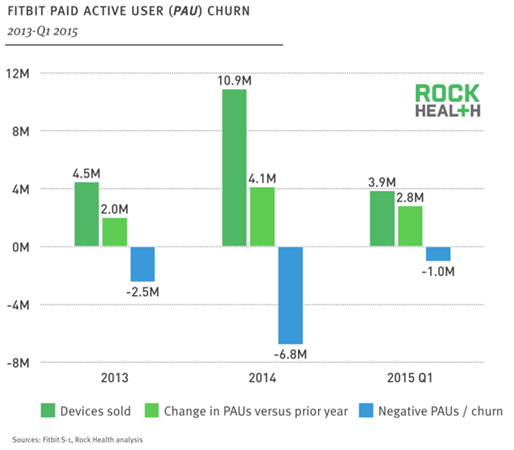

There has been substantial concern that the majority wearable device consumers will eventually quit using them and that the drop is quite steep initially. Although Fitbit provides limited data on user engagement, recent analysis from Rock Health helps approximate what the attrition rate is for Fitbit’s user base. In its filing, Fitbit presents a metric dubbed Paid Active Users (PAUs). A PAU is a user that in the last three months has done any of the following: had an active Fitbit Premium or FitStar subscription; paired a tracker or scale to their Fitbit account; logged 100 steps; or logged a weight measurement. Rock Health uses a comparison PAUs versus registered users (RUs) to approximate the level of retention for Fitbit. PAU/RU was 46% in 2014 and grew to 50% in Q1 2015. This seems better than most critics feared, but this metric is biased by a recency effect of measuring in a single quarter versus an entire year. It needs to be adjusted.

Based on the adjustment, which creates a new metric called negative PAUs, “more than 70% of Fitbit purchasers from the first three quarters of 2014 churned before the end of the year.”

With an attrition rate like that, there needs to be additional debate in the corporate wellness community about purchasing Fitbits and other devices. The price points of Fitbits, which are only increasing, cause employers to spend a significant amount of their budget on devices that may be drastically under-utilized. This is why Wellable encourages corporate wellness programs to implement a BYOD wellness strategy that allows employees to use the devices and apps that make the most sense to them. Employers can reallocate the funds traditionally reserved for devices to other engagement enhancing elements of their programs, such as rewards.