The Wellable Blog

Self-Care At Work

Self-Care At Work

How To Engage Manufacturing Workers In Wellness Programs

Power Of Employee Resource Groups (ERGs): HR Guide To Fostering Inclusion & Success

How Many Steps Do We Really Need: A Scientific Review

Understanding The Family And Medical Leave Act (FMLA): A Comprehensive Guide For Employers

Study: Sleep Deprivation Raises Diabetes Risk, Even With Healthy Diet

Survey: Consumer Wellness Trends In 2024

60 Wellness Challenge Ideas For 2024

Supporting Neurodiversity In The Workplace

Study: Annual Physicals Fall Short In Improving Health Outcomes

Study: Exercise To Combat Depression In The Workplace

Comprehensive Guide To Employee Wellness: Innovative Workplace Wellness Strategies

AI In HR 2024: Transforming Talent With Technology

2024 Employee Appreciation Day Guide: Activities, Gifts, And Quotes To Celebrate Your Employees

Wellness Champions 101: The Key To Optimizing Employee Wellness Programs

Australia Proposes ‘Right To Disconnect’ To Protect Work-Life Balance

Relocate Or Resign: IBM’s RTO Ultimatum

Social Determinants Of Health: Employer Guide To Promoting Health Equity

Study: 69% Drop In High-Paying Remote Jobs

Fastest Growing Software In 2024: Wellable Recognized As A Top 100 Product

Self-Care At Work

Self-care is crucial to maintain balance and health. Explore self-care tips for employees and strategies for employers to support their workforce's well-being.

How To Engage Manufacturing Workers In Wellness Programs

In the manufacturing sector, where shift work, physically demanding tasks, and limited healthy lifestyle options are common, wellness programs can be transformative in improving employee well-being. Beyond the benefits for employees, wellness initiatives have been shown to reduce absenteeism, boost productivity, uplift morale, and reduce healthcare costs. However, research indicates a noticeable gap in wellness […]

How Many Steps Do We Really Need: A Scientific Review

Is 10,000 steps really the golden number for optimal health? Discover how you can achieve significant health benefits with fewer steps than you might think.

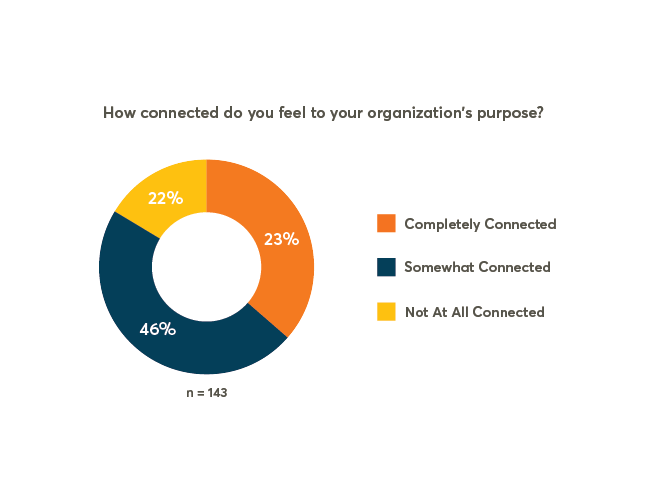

Pulse Check: 20% Of Employees Not Connected To Their Organization’s Purpose

Though employees are looking for meaningful jobs, many feel disconnected from their organization’s purpose. Explore why missions aren’t resonating with workers and learn what employers can do to better harness the power of purpose.

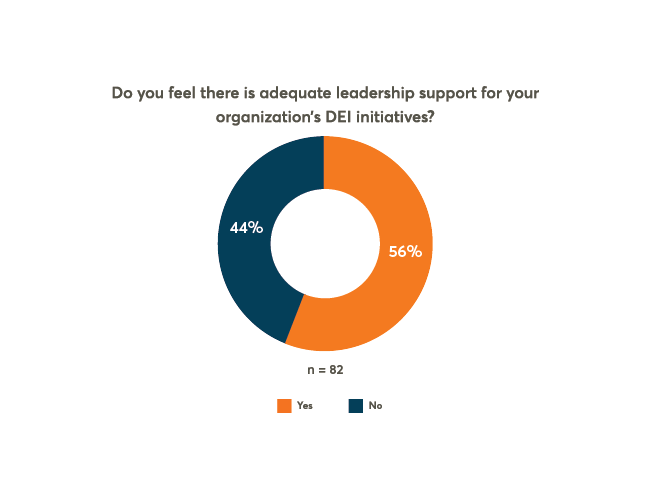

Pulse Check: 44% Of Employees Feel There Is Not Enough Leadership Support For DEIB

While most organizations have implemented DEIB strategies, employee perception of leadership support is low. Find out why and how to fix it.

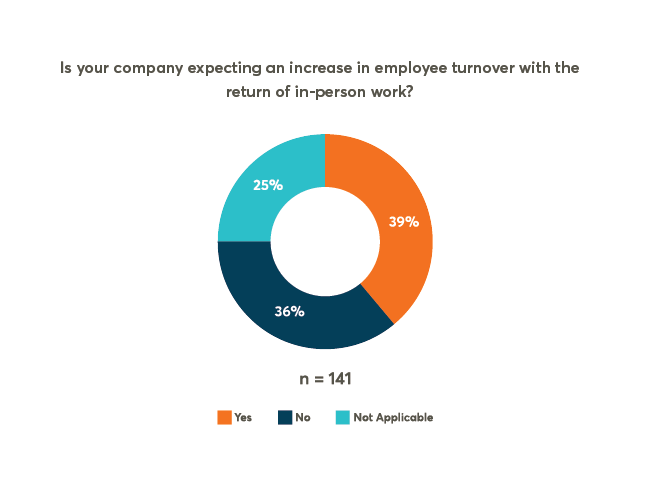

Pulse Check: Will The Return To In-Person Work Exacerbate The ‘Great Resignation’?

With resignation rates near their all-time highs, employers question whether their return-to-office plans will make matters worse. Check out these five tips for retaining talent during the transition back to in-person work.

How To Engage Manufacturing Workers In Wellness Programs

In the manufacturing sector, where shift work, physically demanding tasks, and limited healthy lifestyle options are common, wellness programs can be transformative in improving employee well-being. Beyond the benefits for employees, wellness initiatives have been shown to reduce absenteeism, boost productivity, uplift morale, and reduce healthcare costs. However, research indicates a noticeable gap in wellness […]

2024 Employee Appreciation Day Guide: Activities, Gifts, And Quotes To Celebrate Your Employees

National Employee Appreciation Day is the perfect time to go the extra mile in expressing gratitude for employees. Explore ways to celebrate, gift ideas, and inspirational quotes that will elevate any card.

11 Employee Engagement Statistics You Should Know For 2024

Employee engagement is key to every company’s success, yet 2/3 of employees are disengaged at work. Explore 10 employee engagement statistics for 2024.